The Role of Insurance Coverage in Financial Planning: Safeguarding Your Properties

Significance of Insurance Coverage in Financial Preparation

Insurance plays a crucial duty in a person's monetary preparation method, working as a guard versus unforeseen events that might endanger monetary stability. By reducing threats connected with wellness problems, residential or commercial property damage, or responsibility cases, insurance gives an economic safeguard that permits individuals to maintain their financial well-being also in negative situations.

The importance of insurance coverage prolongs past simple financial protection; it additionally promotes lasting economic discipline. Normal costs repayments encourage individuals to spending plan efficiently, ensuring that they designate funds for prospective threats. Particular insurance coverage items can serve as financial investment vehicles, adding to riches build-up over time.

On top of that, insurance can enhance a person's capacity to take calculated risks in other locations of financial preparation, such as entrepreneurship or investment in genuine estate. Understanding that there is a safeguard in location enables greater self-confidence in going after possibilities that could or else seem daunting.

Eventually, the combination of insurance policy into economic preparation not only secures properties but likewise assists in an extra durable economic method. As people navigate life's unpredictabilities, insurance stands as a foundational aspect, enabling them to develop and protect riches over the long-term.

Sorts Of Insurance Policy to Think About

When reviewing a thorough monetary strategy, it is necessary to think about various sorts of insurance that can address various elements of threat administration. Each kind serves a distinct purpose and can secure your possessions from unexpected events.

Health insurance coverage is vital, covering medical expenditures and guarding versus high health care prices - insurance. Property owners insurance policy protects your residential or commercial property and possessions from damages or burglary, while additionally providing liability coverage in case someone is hurt on your facilities. Vehicle insurance policy is vital for vehicle owners, supplying protection versus damage, theft, and obligation for injuries sustained in accidents

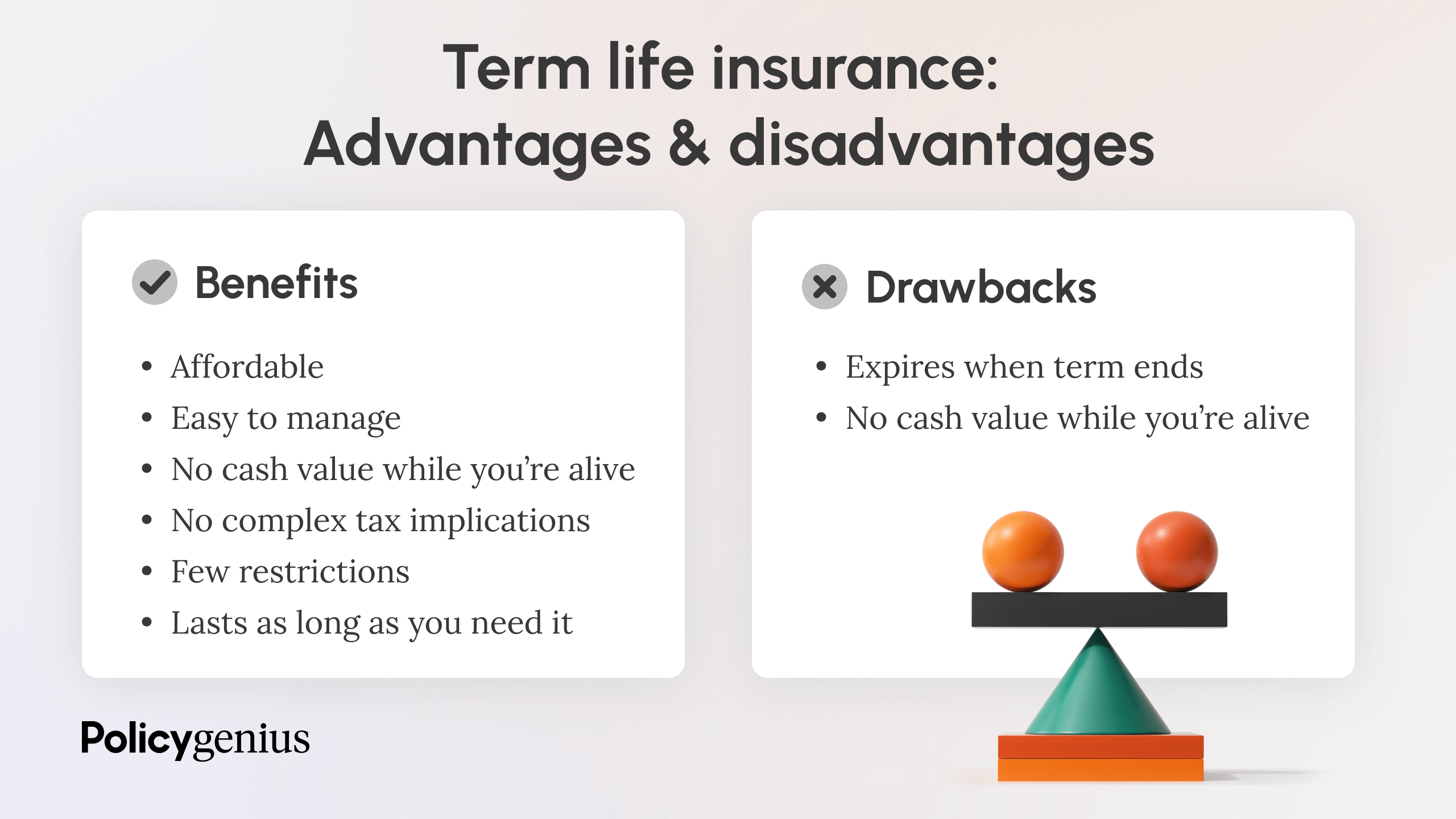

Life insurance supplies monetary safety for dependents in the occasion of an unfortunate death, ensuring their demands are fulfilled. Special needs insurance policy is equally crucial, as it changes lost earnings throughout durations of health problem or injury that prevent you from working. Additionally, umbrella insurance coverage supplies added liability protection beyond standard policies, providing an included layer of security against substantial cases.

Evaluating Your Insurance Coverage Demands

Determining the proper degree of insurance coverage is an important step in guarding your economic future. To analyze your insurance policy requires successfully, you need to begin by reviewing your existing assets, obligations, and total financial goals. This involves thinking about factors such as your income, savings, investments, and any debts you may have.

Following, recognize possible threats that could impact your monetary security. As an example, analyze the probability of occasions such as ailment, crashes, or residential property damages. This risk assessment will certainly aid you figure out the kinds and quantities of insurance coverage needed, consisting of health, life, car, disability, and home owner's insurance policy.

In addition, consider your dependents and their monetary needs in case of your unforeseen passing - insurance. Life insurance may be vital for making sure that liked ones can keep their way of living and fulfill monetary commitments

Integrating Insurance With Investments

Integrating insurance with financial investments is a strategic strategy that boosts financial safety and security and growth capacity. By straightening these two essential components of financial planning, people can develop an extra resistant financial profile. Insurance coverage products, such as entire life or universal life plans, usually have an investment part that enables insurance holders to gather cash value in time. This double benefit can offer as a safeguard while likewise adding to lasting wealth structure.

Furthermore, integrating life insurance policy with financial investment approaches can provide liquidity for beneficiaries, ensuring that funds are offered to cover instant expenditures or to invest additionally. This harmony permits an extra comprehensive threat administration strategy, as insurance policy can secure against unanticipated circumstances, while financial investments function towards accomplishing economic objectives.

Furthermore, leveraging tax benefits linked with specific insurance coverage products can enhance helpful hints general returns. As an example, the cash money value development in permanent life insurance coverage policies may expand tax-deferred, supplying an unique benefit contrasted to traditional investment automobiles. Efficiently integrating insurance policy with financial investments not just safeguards properties but additionally makes the most of development chances, resulting in a durable financial plan customized to private requirements and goals.

Common Insurance Coverage Myths Exposed

Misconceptions regarding insurance policy can substantially impede efficient financial planning. Many individuals additionally believe that all insurance coverage plans are the same; nevertheless, coverage can vary widely based on the copyright and specific terms.

One more common myth is that more youthful individuals do not require life insurance coverage. Additionally, some think that health and wellness insurance policy covers all medical expenditures, which is not the instance.

Lastly, the idea that insurance is only valuable during emergency situations forgets its role in proactive monetary planning. By integrating insurance into your approach, you can secure your possessions and enhance your overall financial strength. Eliminate these misconceptions to make educated decisions and enhance your economic planning initiatives.

Final Thought

Finally, insurance functions as an essential element of effective financial preparation, offering important security versus unanticipated risks and adding to property security. By understanding various sorts of insurance and analyzing private requirements, sites one can accomplish a balanced economic strategy. The combination of insurance policy with financial investment possibilities boosts wide range accumulation while ensuring financial Visit This Link security for dependents. Dealing with usual misconceptions concerning insurance also advertises informed decision-making, inevitably cultivating a much more resistant economic future.

In the world of financial preparation, insurance serves as a foundation for guarding your possessions and guaranteeing long-lasting security.The importance of insurance policy prolongs past simple monetary defense; it likewise promotes long-lasting monetary technique.False impressions about insurance coverage can dramatically impede reliable financial preparation.Lastly, the belief that insurance is just beneficial throughout emergencies forgets its role in proactive monetary planning.In verdict, insurance offers as a fundamental part of effective economic planning, providing essential defense against unforeseen threats and adding to property safety.